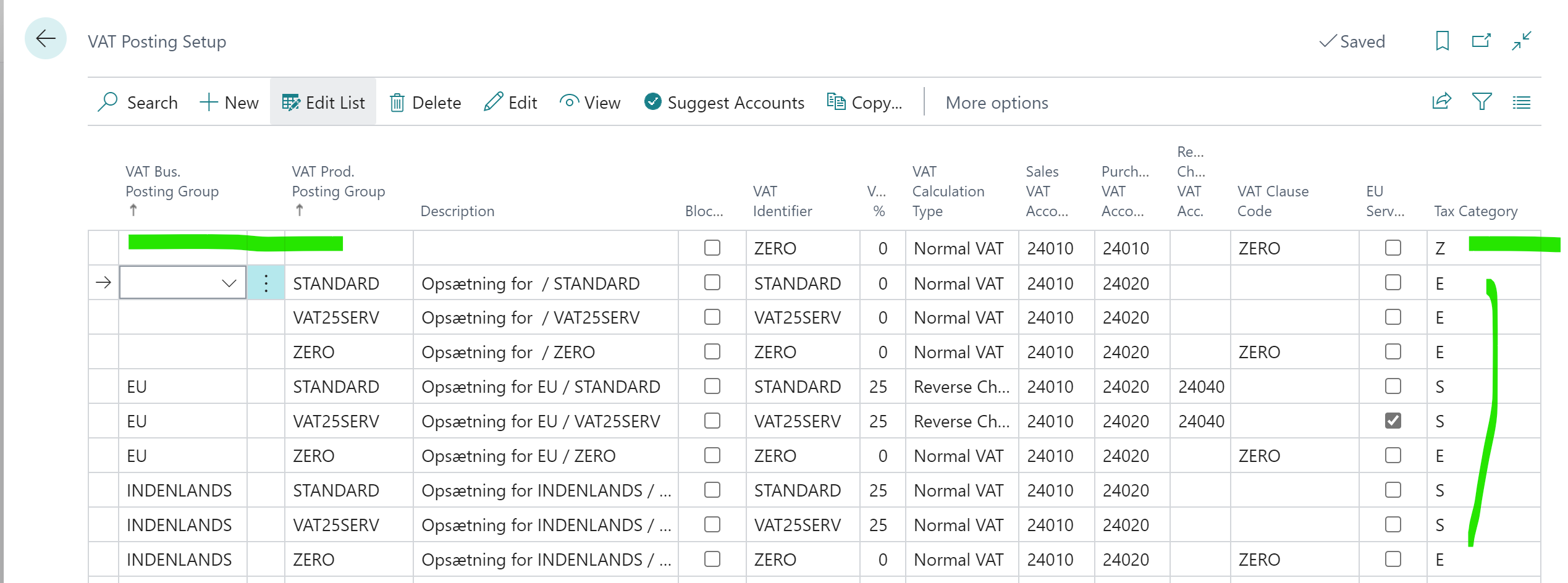

1. At least one blank/empty posting setup line is required, the Tax category must be Z.

2. In VAT posting setup, and add the right Tax category most used are S,E,Z, in the Tax category field.

The complet list

E

Exempt from Tax

Code specifying that taxes are not applicable.

S

Standard rate

Code specifying the standard rate.

Z

Zero rated goods

Code specifying that the goods are at a zero rate.

AE

Vat Reverse Charge

Code specifying that the standard VAT rate is levied from the invoicee.

G

Free export item, VAT not charged

Code specifying that the item is free export and taxes are not charged.

O

Services outside scope of tax

Code specifying that taxes are not applicable to the services.

K

VAT exempt for EEA intra-community supply of goods and services

A tax category code indicating the item is VAT exempt due to an intra-community supply in the European Economic Area.

L

Canary Islands general indirect tax

Impuesto General Indirecto Canario (IGIC) is an indirect tax levied on goods and services supplied in the Canary Islands (Spain) by traders and professionals, as well as on import of goods.

M

Tax for production, services and importation in Ceuta and Melilla

Impuesto sobre la Producción, los Servicios y la Importación (IPSI) is an indirect municipal tax, levied on the production, processing and import of all kinds of movable tangible property, the supply of services and the transfer of immovable property located in the cities of Ceuta and Melilla.

B

Transferred (VAT), In Italy

VAT not to be paid to the issuer of the invoice but directly to relevant tax authority. This code is allowed in the EN 16931 for Italy only based on the Italian A-deviation.